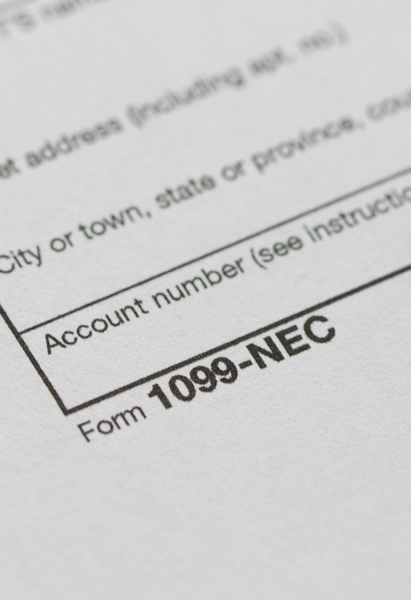

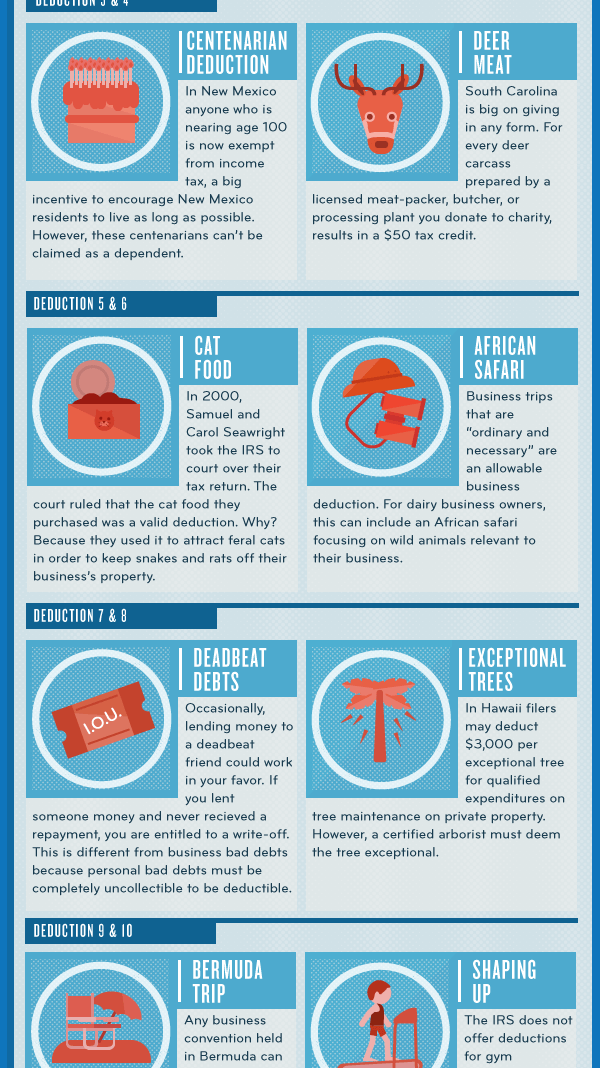

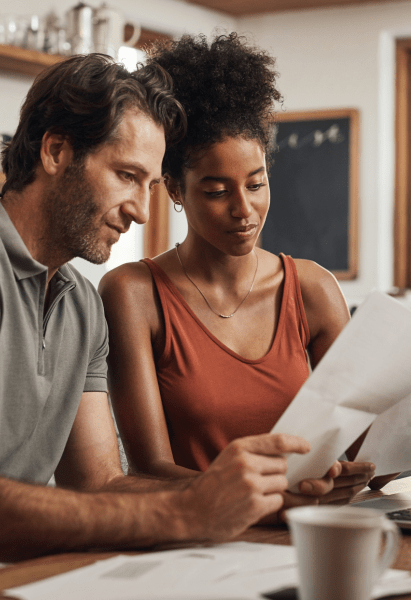

What’s Tax Deductible? A Guide to Mortgage Interest, Long-Term Care, Funeral Expenses, Student Loans, and Roth IRA Contributions

Understanding Tax Strategies for Real Estate Businesses: Navigate Deductions, Credits & Audit Preparedness

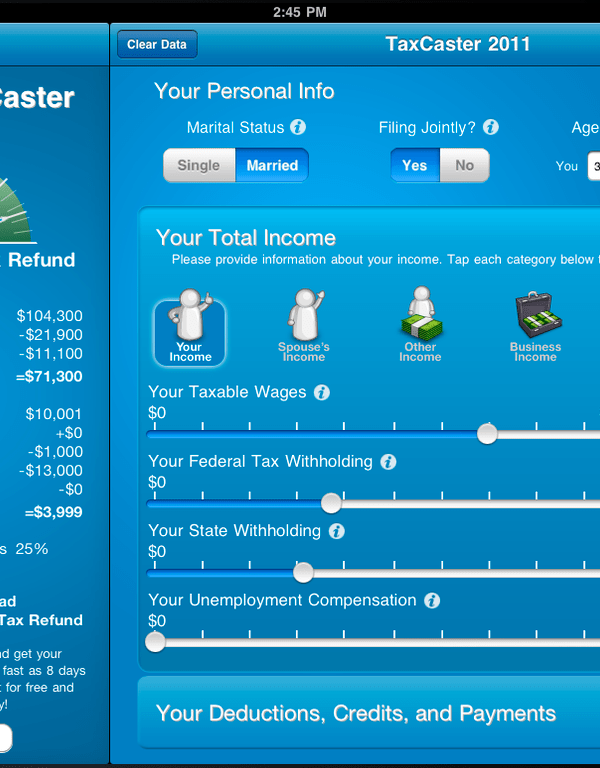

TurboTax and CoinTracker Partner to Help You Seamlessly Calculate and Import Crypto and Investment Transactions at Tax Time

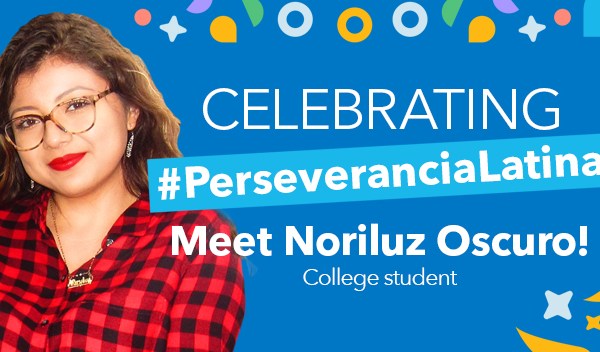

Need Financial Help for School? TurboTax Launches 2nd Year of the #LeadingConEducación Scholarship Program

TurboTax Kicks Off its 2021 Hispanic Heritage Month Celebration with Stories of Perseverance and Strength

“Sí se puede”: TurboTax Survey Shows Young Latinos Believe Having a Higher Education Means a Brighter Future

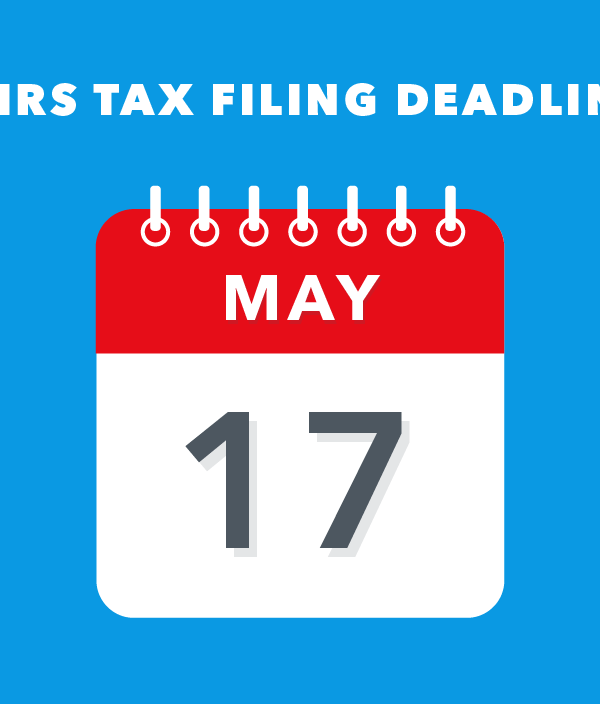

What is My State Tax Deadline? What to Know About Coronavirus and State-Specific Tax Year 2020 Tax Deadlines

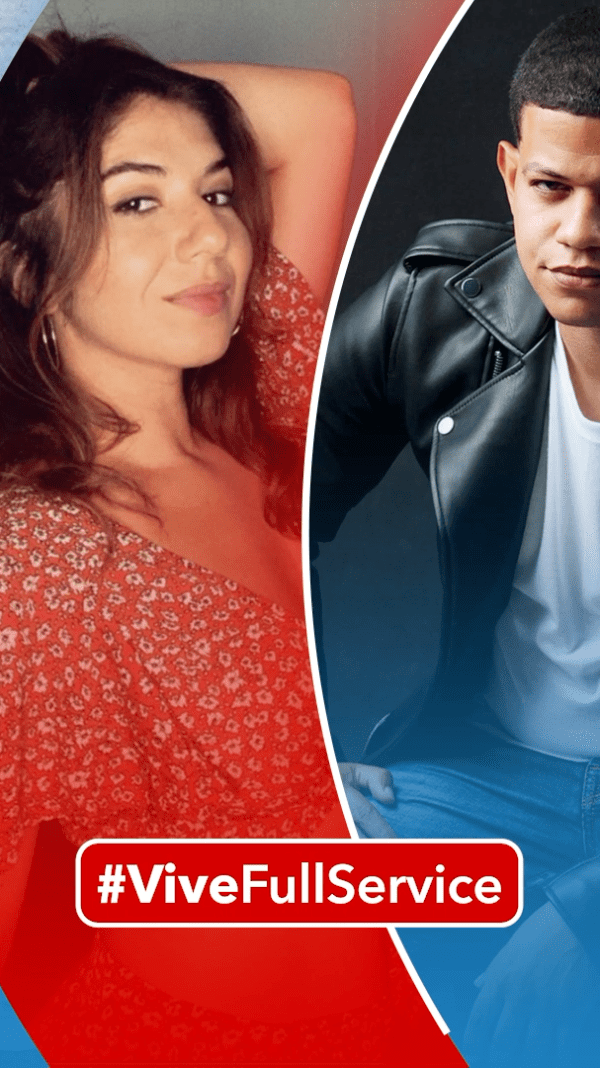

TurboTax Spotlight: Tax Expert Miguel Shares Why TurboTax Live Full Service is a Gamechanger for Taxes

Intuit TurboTax Live Scores a Touchdown as Official Sponsor of the AFC & NFC Divisional and Championship Games

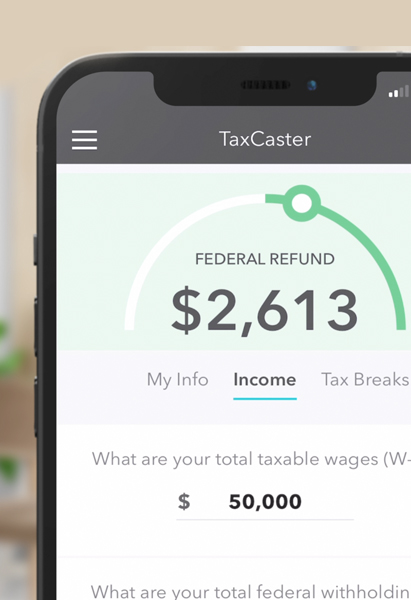

Tax Credit Estimator Educates Self-Employed Individuals on How to Calculate Credits Related to COVID-19

How Does Coronavirus (COVID-19) Relief and the Tax Year 2019 Tax Deadline Extension Affect My Tax Payments?

TurboTax To Help Millions of Americans Get Their Stimulus Payments with Launch of Free Stimulus Registration Product

Was the Tax Year 2019 Tax Deadline Delayed? What to Know About Coronavirus (COVID-19) and Your Taxes

Families First Coronavirus Response Act: Everything Taxpayers Need to Know About the New Relief Bill

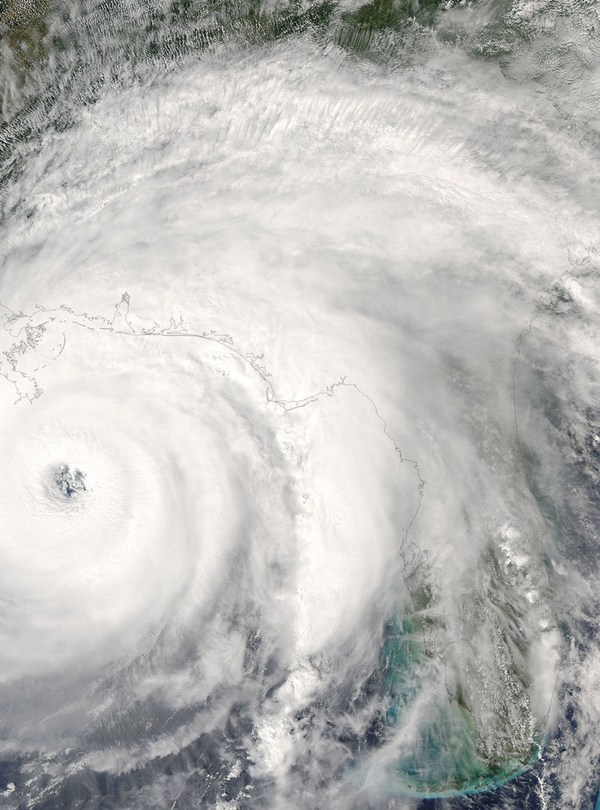

Hurricane Victims Get Additional Relief with the Disaster Tax Relief and Airport and Airway Extension Act of 2017

Real Talk: I Recently Lost My Job. Am I Able to Deduct My Travel or Vehicle Expenses While I Job Search?

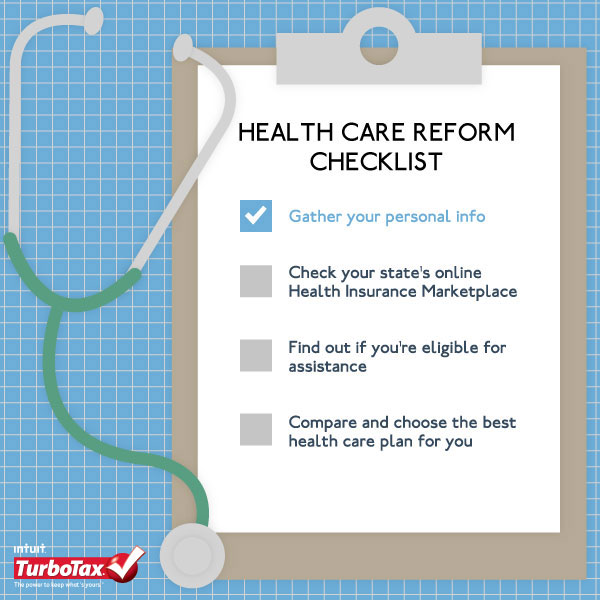

Affordable Care Act Health Insurance Marketplace Open Enrollment is November 1st through January 31st [Video]

Supreme Court Rules Marriage Equality in All States Further Simplifying Tax Preparation for Same-Sex Couples

Affordable Care Act Update: Millions of Americans Can Continue to Get Subsidies Through the Health Insurance Marketplace

Did You File a Tax Extension? You May Qualify for an Affordable Care Act Exemption When You File Your Taxes

Affordable Care Act Update: Treasury Announces Expanded Relief for Taxpayers Receiving Corrected 1095-A Forms

Good News For Uninsured Taxpayers! Affordable Care Act Open Enrollment Period Extended from March 15 to April 30, 2015 [Video]

Good News For Uninsured Taxpayers! Affordable Care Act Open Enrollment Period Extended from March 15 to April 30, 2015

Health Care, Taxes, and You: I received an advanced premium tax credit to offset the costs of health insurance. How will I know if I owe more money when I file my taxes?

Health Care, Taxes, and You: What Subsidies Offset Health Insurance Purchased in the Marketplace and Who Qualifies?